5 Key Steps to Successful White Label Casino Integration! The providers are selling launches in weeks. Reality is made up of technical and regulatory contingencies which are extensions of timelines additions which lack verbal explanation.

Sign no requirements map and a white label contract and you are purchasing a promise; not a launch plan.

Most operators do not realize the complexity of the casino integration process when payments, licensing and system interoperability are added to the process.

It is either you are seeking to initiate a white label casino or you are viewing through a turnkey casino integration, the sooner you know about these dependencies, the less trouble you will encounter in the long run at paying a significant amount.

However, the real white label casino integration process is not so much like throwing a switch but rather like sequencing a multi-system implementation through the regulatory stress. Whether payments. KYC. reporting jurisdictional thresholds, or API maturity. They all have their own time of their own.

And have you gone wrong with your sequencing?

You have a long time. You are more exposed to compliance. Your capital is on fire and the dashboard is indicating that it is almost ready.

What does a white label casino integration mean?

White label casino integration is the coordinated effort of licensing, payment system, game API, compliance module and infrastructure integration on the platform of a provider. It is meant to create and operate an online casino where the operator has retained the risk and AML obligations.

The subordinate attention in terms of the use of bots and RTA tools, and the assistance of AI in the game process has increased in the regulated market, which is why open compliance records and the possibility to audit systems are necessary.

And What You Will Learn

It will not be like a list of vendors. It will be like a map of operations.

You will observe:

- The intention of the decision to integrate is premeditated before signing.

- The unaccompanied enforcement of architecture through licensing.

- This is where the casino integration process is the least successful.

- The explanation behind the core stack being the determinant between soft launching and fracturing is because of its sequencing nature.

It will be step by step. There will be no hype. There will be no shortcuts. There shall be the structural reality operators.

Negotiate Business Requirements and Business Goals.

A white label casino facility will take off or fail depending on the clarity of requirements. Establish targets of locking with the vendor; schedules are as follows.

That is backwards, provider demos are the beginning of most founders.

The faster the integration speed is, the better, the requirements are defined at the start. Not due to the speed of the providers, but due to eradication of ambiguity. And vagueness is that which widens the range of integration.

This is where this usually collapses.

The requirements of a founder are:

- Access to the EU;

- Cryptocurrency payments;

- Flexibility in VIP program;

- Rev-share model;

- Quick withdrawals;

- No high KYC.

Paperwise, all right, but business model decisions: rev-share, VIP treatment; crypto acceptance; change routing of payments, reporting load, KYC requirements, significantly. What seems to be a branding choice is actually an architecture choice.

At this stage, white label casino set up is transferred to dependency mapping.

What to Lock Before You Sign (Principles of online casino launch).

And prior to you signing any contract you must be aware:

- Target jurisdictions;

- Fiat, crypto, hybrid payment mix;

- AML exposure tolerance;

- Frequency of reporting;

- Bonus engine restrictions;

- Track level of following affiliate.

Mismatch between operator interests and provider capacities is one of the leading causes of delays. Not due to misleading by the providers, but due to the assumption of compatibility by the operators.

The sad thing about it is the following:

- Any requirement that is not defined is an extension of the schedule.

- Modifying Requirements that Change Timelines.

The complexity of integration is silently increased by some of the requirements:

- Multi-currency wallets;

- KYC minimum based on the area;

- VIP handover pipes;

- Special reporting pipes;

- Third party affiliate integrations.

Business-to-tech traceability, which gives a mapping of all business goals to technical dependency, removes rework.

In the absence of such a traceability, integration is responsive.

The companies can use micro-case (Anonymized Operator) in order to advertise their services.

One of the founders will be on two-week deployment. Traffic pre-campaign will commence. Domain will be secured.

The routing of payments audit reveals that it can not be compatible: their proposed crypto-fiat hybrid will require new AML layers and PSP verification cycles. Six more weeks.

One of the operators put it in the following way:

“We believed that payments are plug and play. They were policies.”

It was not time to be horrific. No scandal. No fall. And platform economics is time that is oxygen.

Stop and think for a moment.

Until you clarify what you need, your provider will impose your restrictions on you.

And constraints have no opportune time.

The burden of mapping is expected at this stage before signing. Otherwise, the next step will be doubling the risk.

Choose a White Label Provider Technologically, Licensed.

Licensing and architecture determine the market entry and penetration. Due diligence is repulsive.

Not every white label casino operator is subject to the same regulating body. And that is more vital than branding.

A white label casino operator can either be based on an MGA licensed white label casino system or a Curacao licensed casino provider system. The white label casino compliance, however, does not remove the operator liability of KYC AML casino integration and reporting supervision.

It is not, as it might appear, at first sight, a badge.

Licensing has effects::

- KYC/AML thresholds

- Reporting rate

- Access by payment providers

- Market eligibility

- Frameworks of player disputes.

The licensing has a direct impact on friction of compliance and routing architecture of payment.

It is at this point that the founders tend to be confused over speed and access.

The Curacao license would have access to additional international markets and restrict growth to the UKGC. The UKGC framework can increase the AML, which is at the expense of the premium PSP partnerships.

Even before you make a single API call, your integration process is altered by various regulatory options in the casino.

Impact and Models of licensing (white label casino compliance) integration Impact.

The pressure may be of the following type:

- UKGC increasing AML supervision, increasing reporting burden.

- MGA to good EU cover, means compliance overheads.

- Less regulation structure, Curacao to greater access.

They will all emigrate your KYC stack and report in some other manner. And even the white label licensing operators bear the AML responsibility.

Read this again if you need. White label does not mean that there is a transfer of liability.

You will need a technical due-diligence checklist for it. Other than licensing, architecture is important.

The white label platforms vary in maturity and richness of documentation of the API. The API validation and technical audits reduce the integration friction.

The integration effort is enhanced when API maturity is low.

It is in this regard that integration is more of an engineering rather than a contract reality. And reality engineering always has its way.

Narrative Pressure

One operator had been granted access to Curacao markets under a license of a provider, but UKGC expansion was prevented by the provider six months later. The re-loading of the stacks, half-way re-building, no disaster, architecture drift.

Now, please answer:

Would you select a provider to launch now, or place more than five years? Through licensing, it does not necessarily mean compliance, but it is strategic geography.

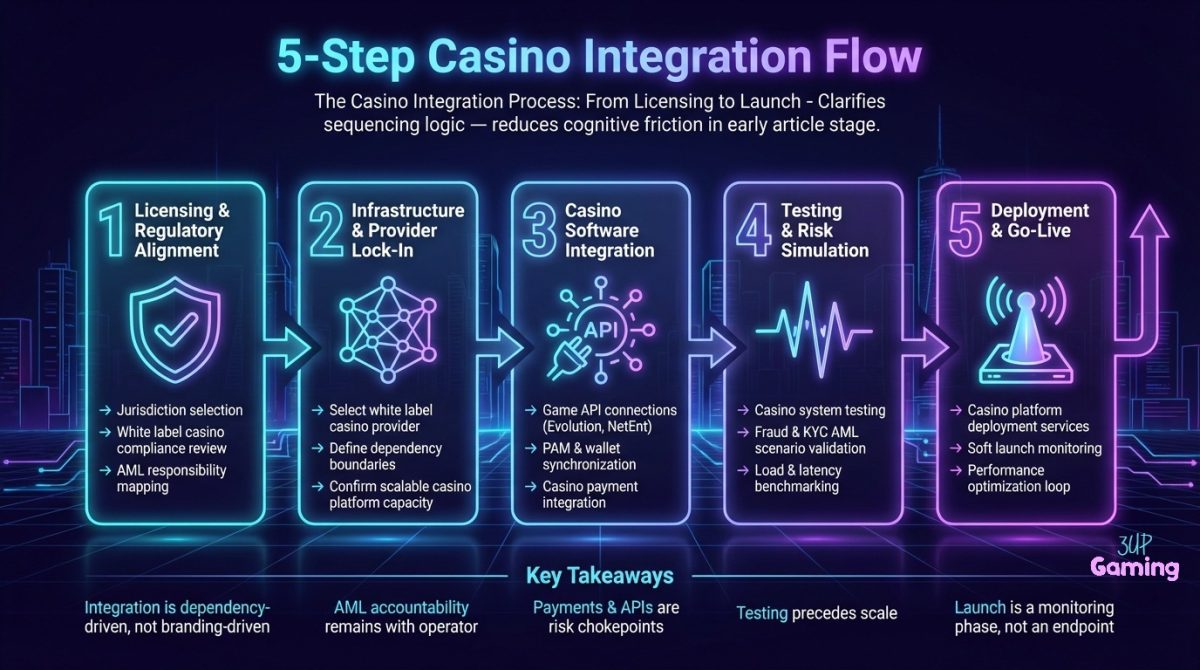

Combine Games, Payments and KYC Systems in the proper way.

The fundamental stack (e.g. PAM, game aggregation, payments, KYC) need to be tested and verified successively. Misconfiguration is the major cause of launch failure.

It is at this point that the majority of white label casino integration projects break.

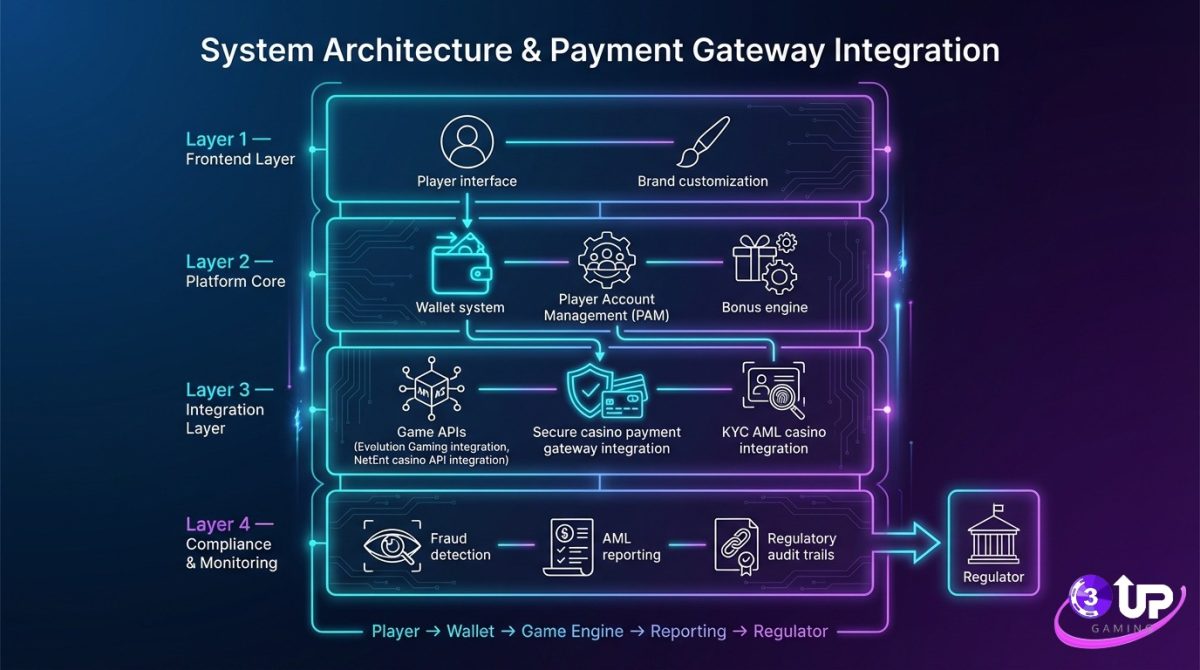

The white label sites are developed using the modular architecture: PAM (Player Account Management), Game aggregation layer, Payment gateways, KYC/AML systems.

These systems are to be sequenced and end to end tested.

They are interdependent and operators are inclined to treat them as parallel integrations. The implementation of the payments routing and KYC depends on the jurisdiction and structure of a provider. KYC and reporting are automated and the disputes and VIP management are manual. The most common reasons for failed launches are poor configuration of KYC or payment flows.

Now pause. This, as you may suppose, may be no complicated affair at all, till you make the dependencies. Until you draw the dependencies.

Basic Systems that ought to fit (integration of casino software)

In poker, it is referred to as pre-flopping to get the stack.

You have:

- Onboarding of players (KYC entry gate)

- Wallet creation (PAM binding)

- Routing of deposits (PSP hand shake)

- Game launch authorization

- RTP reporting loop

- Withdrawal validation

Each of them calls another system.

The payment routing is prevented in case of a threshold detected by KYC.

Aggregation will be halted in case wallet mapping does not meet currency logic.

In the event of a discrepancy in reporting pipelines, noncompliance warnings are turned on.

This is the sphere in which the casino software integration will not be much of the UI, but more of the sequencing logic.

Technically, the integration of casino software should coordinate the integration of the Player Account Management system, game APIs, and secure casino payment gateway integration devoid of latency or reconciliation issues.

Soft launching of the complete loop test is needed.

Most Integrations Crash Unannounced.

Significant white label casino failures are not present at the initial launch, but happen 30 to 90 days later when the payment to reconciliation ratio is breached, AML alerts volumes are out of control, or reporting dashboard lags growth.

It is not the question of branding, but more frequently the blindness in dependency in the process of casino integration.

Normal Bottlenecks and Test Cases (KYC AML casino integration)

Here is where trouble gets into.

The most common bottlenecks are:

- Misroutes of payment switches

- KYC thresholds mismatch

- PSP time outs

- False positive in AML flags

- Bonus engine miscalculations are the most widespread.

One of them said:

On the first day our withdrawals ceased. This did not happen because of the shortage of funds, and instead, it happened because of the misdirected compliance flags being switched.

It is not a marketing failure. That is sequencing failure. The testing and pilot launches decrease the failures that occur after the launch. Most of the operators, however, do not estimate the depth of the test required.

Severe sequence of integration will entail at least:

- 10 full user journey tests.

- Multi-currency withdrawal simulation.

- Stress test of large value withdrawal.

- KYC escalation situation test.

- PSP fallback routing test.

Here is the point of analysis. This is the point where you have established goals. The architecture that you have chosen is licensing architecture.

And you know something: The white label casino integration process is not about fitting systems together.

It is of regulatory level interdependencies. You can go fast. Or you can go right. Rarely both..

Personalize Branding, User Experience and Gaming.

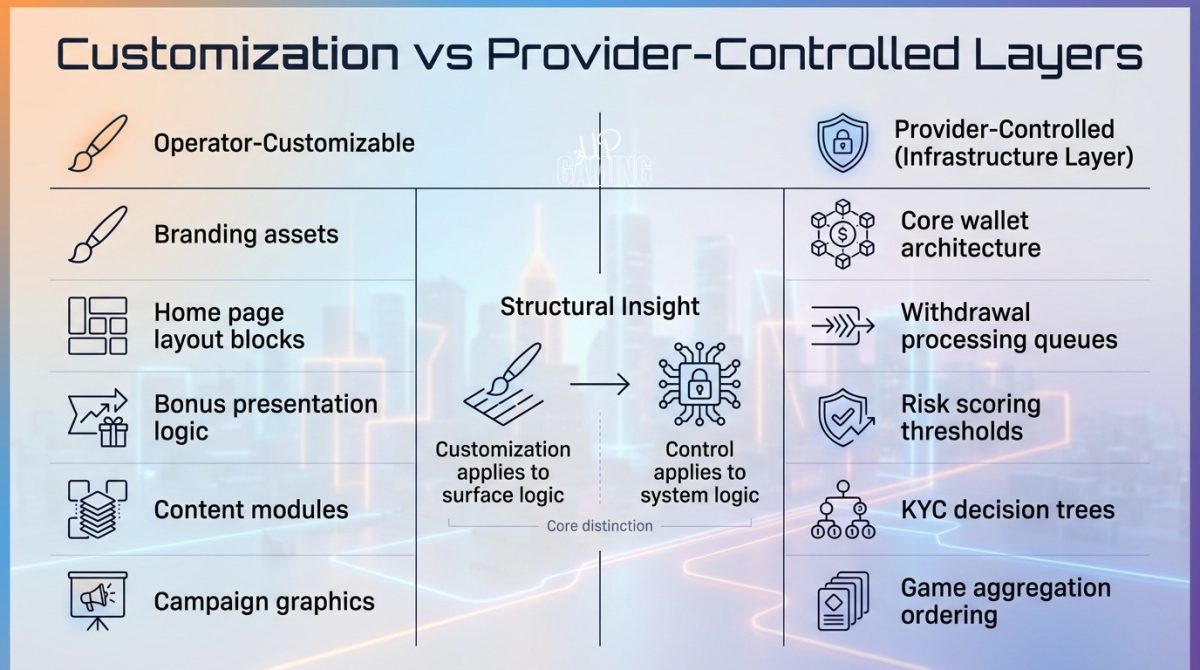

Customization of casino platforms is powerful, but restricted. These are retention limits, friction and trust onboarding, provider plans and compliance laws which you can modify.

Dependency vs Ownership

Operators have to make a decision whether to own infrastructure or a permanent dependency. The first benefit of turnkey casino integration is that it makes the process less complex, whereas it might hamper the ability to tailor the casino platform and payment flexibility in the long run.

When you implement an online casino infrastructure on a white-label basis, the degrees of branding are generally in your hands: logo, color scheme, tone of the content, promotional framing. The less complex front-end systems, wallet logic, KYC trigger place or withdrawal queue architecture are the ones that you do not necessarily get to control.

It is also possible that the operators tend to overestimate the flexibility of customization due to the limitations of the providers. The difference between the expectation and structural reality is the accrual of the UX debt.

Customizable vs Provider-Controlled Layers

This is among the key differences and UX is linked to retention, friction onboarding, and responsible gaming compliance.

On UI layers and bonus logic but none on core wallet architecture or fraud engine, customisation of casino platforms is undertaken in a standard fashion.

Most providers have their own model of ownership of infrastructure, which restricts the custom casino platform integration services. You are able to build a no friction onboarding screen.

Nevertheless, in the case of KYC escalation in the middle of the deposit, the friction returns. You can come up with a non-bumpy exit button.

There is however a difference in the speed perception when the withdrawal validation is in a compliance line.

One of the operators found out the following:

“Our UI was high quality. But the withdrawal delay was being felt by the players. That was where trust was lost.”

The slickness of the UI cannot be beaten by a sticky UI as the implication of the logic of bonus, withdrawal flows, and support policies have a huge effect on the sense of fairness and risk exposure.

The instinct behind this is easy: Branding is good. Architecture is orthodox. Versus architecture of details, and then vs. projected elements.

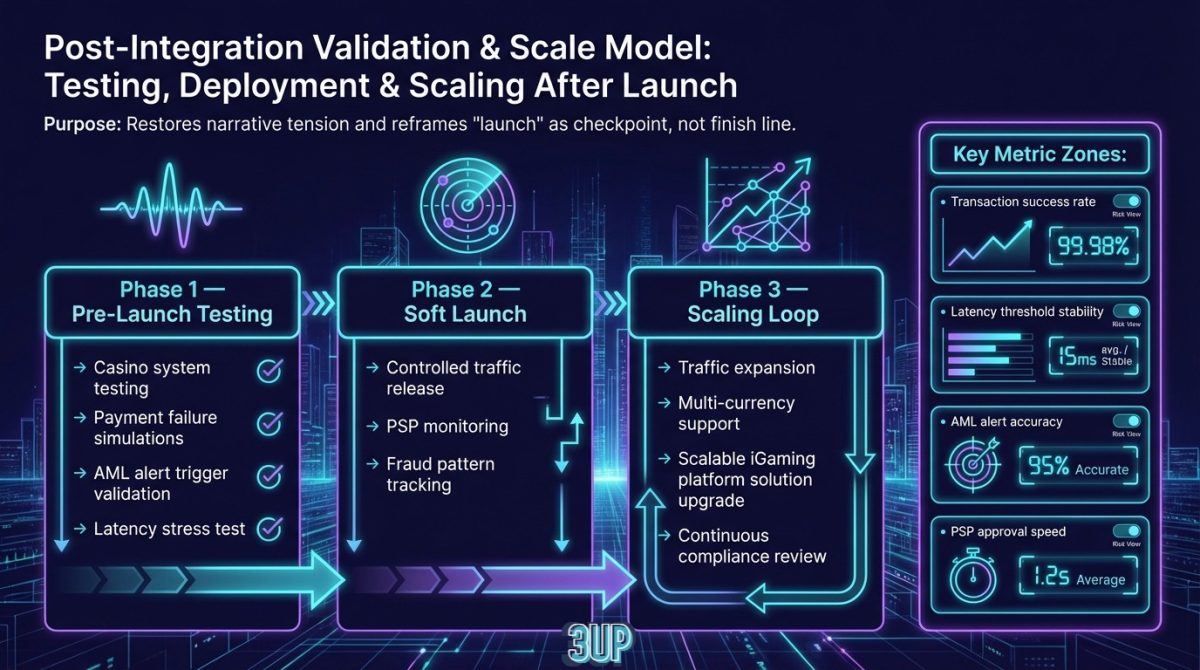

Testing, Launches and Optimization of Long-term Performance.

The casino system testing is what is called the risk-reduction engine. KYC, pre-scaling aggregation and reporting and stress payments. Dependency resolution Not a time of the year.

Before the deployment of the casino platform fully, casino system testing is predicted to simulate payment reversals, AML breaches, third-party API failures.

The actual procedure is as under there are few operators who pass through online casino start-up procedures without checking the circumstances of payment edges which results in the roughness of post-launch that is harmful to retention.

The testing minimizes the risks of failure after it is launched. This is not made to occur in the elimination of risks but in the interdependencies that emerge preceding the amplification of the traffic.

This is preceded by serious white label deployment and staged deployment. There can be no bargaining concerning the stress-testing payment routing, KYC flows and aggregation endpoints. The compliance tests to be taken are AML triggers and reporting pipelines.

The operators too are subjected to AML; despite the white label arrangements. This means that supervising it cannot be done to full extent.

After Go-Live Loops (optimization): Loops (Scalable casino platform)

Scalable casino platform is not based on front-end design but is based on database architecture, PSP redundancy and automation of reporting.

A scalable iGaming platform solution should be able to project a traffic peak in case of identical promotions or introducing new games like Evolution Gaming integration rollouts and NetEnt casino API integration rollouts.

One usually proceeds with optimization as soon as it is stable.

Scalable casino platform is grounded on surveillance measurements which include deposit-to-registration conversion, KYC drop-off rates, turnaround time on withdrawal, frequency of chargeback, aggregation latency, and patterns of fraud.

To optimize all these, the performances of players, indicators of frauds, and performance that the system can deliver must be tracked continuously.

A KYC drop-off spike was registered at a certain level of threshold value in one of the soft launches, UX also had to be restructured, it was not eliminated, it was rearranged.

It does not appear to be reactive patching but rather seems to be; the optimization of the discipline, but a structured negative feedback mechanism.

Closing the Poker Hand

- Pre-flop: You had been spearheading about specifications.

- Flop: You are telling me that you are licensed architecture.

- Turn: Stress-tested and completely sequenced.

River:

- You all walk out when you are attached.

Showdown:

- The fastest ones do not have the highest success.

- They are disciplined most in structure.

Variance does not disappear. Regulatory changes occur. The payment providers remodel the policies. But civilized when they have already swallowed shocks, they are out-manoeuvred by inexperienced rushes.

The Blueprint of Success of Casino Integration: The Requirement and Risks.

The four stages of integration of a de-risked turnkey casino are established upon the following non-negotiables: requirements mapping, licensing verification, API audits, and structured testing. Operators are still responsible in regards to AML and UX.

Here is the judgment.

Complexity cannot be eliminated in white labels.

It reduces it into integration sequencing.

Non-negotiables:

- Requirements pre-selection of the vendor.

- registering paper work and conformity certification.

- API maturity verification

- Implementation plan and stress test plan.

Express AML oversight ownership.

What this does:

- Minimizes likelihood of failure on the launch.

- Shortens rework cycles

- Exposure to regulation report.

- Smooths out payment activities.

What this does not do:

- Eliminate compliance risk

- Guarantee PSP approval

- Eliminate jurisdictional instability.

- Substitute operational discipline.

Turnkey casino integration is not purchasing a lottery ticket.

The validation of a dependency chain is going on.

When you are coming up with online casino infrastructure, stop and think before you sign, and cross-examine your map of integration with these points.

Key Takeaways

- The rate of integration starts with the clarity of requirement.

- The licensing regime stipulates the technical and market restriction.

- PAKYC, aggregation, payments and KYC have to be end-to-end tested.

- The responsibility of operators towards AML in white label structures remains.

- Soft launching and staged testing minimize the post launching instabilities.

When your plan on hand is unable to respond to these five points clearly then you are still pre-flop.

Create a one-page dependency map of integration before involvement with a provider and confirm the company licensing, payment, and KYC restrictions. In case you desire packaged schemes of entrepreneur gaming construction, consider the technical documentation of 3UP Gaming and platform, to compare your integration pattern.

Further reading

External Sources

- UK Gambling Commission, Remote Gambling and Software Technical Standards (RTS) 2024 Edition.

Regulatory requirements that outline API-level reporting requirements, affordability checking logic and system integrity requirements.

Brings the thesis of verification shift in the article directly to the point; operator RTS testing is no longer a matter of discussion. - Malta Gaming Authority Systems Audit Guidelines (2023 Revision).

Registered system controls, AML/KYC requirements and operational controls.

Favors the concept of jurisdictional fragmentation research and provider technical due-diligence. - Ayres, I. and Braithwaite, J., Responsive Regulation: Beyond the Deregulation Debate, Oxford University Press (1992)

Risk-based supervision and co-regulatory models Foundational text.

Reports the framing of UKGC/MGA compliance architecture in the article as continuous audit, as opposed to periodic attestation. - Rochet, J.C. and Tirole, J., “Platform Competition in Two-Sided Markets, Journal of the European Economic Association (2003).

Pricing power, cross-side network effects and platform lock-in Landsmark economic model.

Gives theoretical support to rev-share compression analysis (35-45% shift) and provider dependency. - Floridi, L. & Cowls, J., Harvard Data Science Review, 2019, A Unified Framework of Five Principles of AI in Society.

Ethical AI governance model: accountability, transparency, non-maleficence.

Bases the EU AI Act and black-box risk scoring non-deployability thesis of the article analysis. - Gaming Laboratories International (GLI-19): Interactive Gaming Systems Standards (Version 3.2)

Technical certification Game aggregation, RNG fairness and interoperability testing standards.

Tests the casino system testing sequences and integration validation procedures of the article. - H2 Gambling Capital: Global Gambling Market Outlook Report (Q1 2026).

Jurisdictional license contraction, Tier-1 platform consolidation and new market regulation industry intelligence.

Phase-out analysis of Curacao and multi jurisdictional filtering Empirical anchor required.

Internal Links

- Overview of architecture of enterprise poker platform.

- Principles of scalable gaming infrastructure.

- Artificial intelligence compliance and fraud detection solutions.

Glossary: Important Terms in This Article.

- PAM (Player Account Management): This is the main system that manages the player profiles, wallets, balances and transaction histories of a casino platform.

- KYC (Know Your Customer): It is a regulatory control that determines a player to meet the AML and compliance requirements.

- AML (Anti-Money Laundering): A legal system that has been enacted to deter and detect illicit actions in the financial systems of the gaming platforms.

- Game Aggregation: This layer is the integration layer which connects a number of game providers to one platform interface.

- PSP (Payment Service Provider): This is a financial middleman that processes deposits, withdrawals and routing of payments acting on behalf of online casinos.

- Application Programming Interface (API): This is an official communication interface where various software systems can interact with each other in a safe manner, e.g. PAM and payment gateways.

- RTP (Return to Player): This is the theoretical percentage of the amounts wagered on that game that will pay the players in the long-run as an indicator of transparency and fairness.

- RNG (Random Number Generator): An authenticated algorithm that makes the results of the games random and free.

- Scalable Casino Platform: Architecture capable of satisfying the growing traffic, transactions, and regulatory requirements without degrading its system.

FAQs about white label casino integration.

The following white label casino integration FAQs will be used as operation checklists to make sure that founders can assess the risk before establishing an online casino business.

What is the meaning of white label casino integration?

- Formal relationship with licensed infrastructure of a provider, including PAM, payments, KYC and game aggregation, is known as white label casino integration. It minimizes the development time, but not the operation control, AML responsibility and technical dependency control.

So what is the actual length of time to white label casino integration?

- Integration would usually take 6-16 weeks depending on the maturity of the licensing, PSP licensing and API compliance audit. Speed does not mean front-end design, but payment onboarding or KYC configuration, and, therefore, sequencing dependencies is the meaning of speed.

Which systems are to be incorporated in a white label casino?

- The most common core integrations include the Player Account Management system, payment gateways, KYC/AML modules, game aggregation layers, reporting systems, and the fraud monitoring systems. The fact that these systems do not correspond to each other enhances the danger of the operations and may reveal the loopholes in responsible gaming.

Are you licensed and do you comply with the white label providers?

- The providers are mostly providing a master license model and the operators are responsible of the AML control, reporting and marketing compliance. The structure is not so complicated with the help of licensing and the provider still does not give up the compliance of regulations completely.

Do the payment gateways have the ability to be white labelled?

- The personalization of the payment is possible based on the accepted by the provider PSP networks and risk limit. Jurisdiction, underwriting approval and technical compatibility may be necessary in the new gateway introduction, hence the flexibility will vary depending on the infrastructure design and compliance constraints. The decision to integrate casino payment gateway is usually achieved through the application of jurisdictional underwriting and the fraud threshold.

What is the importance of testing before your white label casino is launched?

- Real traffic can be used to find implicit dependencies between payments, and KYC triggers, reporting pipelines and game aggregation can be intensified. AML alerts and fraud simulation are stress scenarios used to reduce the instability in the post-launch to ensure the integrity of the platform.

Will white label casinos be able to scale once started?

- The white label casinos can be scaled in case the infrastructure can ensure the addition of traffic, multi-currency wallets, fraud detection, and reporting automation. The scalability problem is anchored on the architecture design and resistance to branding layers of PSP.

What are the most significant integration errors to make in white label?

- The main failures are lack of responsibility to AML, failure to stage test, inappropriateness of the scope of licensing to market targeting and presumption that the customization goes to core wallet architecture. Dependency blind spots are not the most common causes of failures, but branding decisions.